Trading Online for Beginners guide to teach South Africans how to find a good online stock broker and open a stock brokerage account. The question regarding online trading is, how do I start investing in the stock market in South Africa? Investing in online stocks can grow your wealth and make you rich. Learn all about the stock exchange using our trading online for beginners South Africa guide. Our guide to online stock trading for beginners will give beginners a helpful starting point.

Best Online Stock Trading for Beginners

| Min.Deposit $10 | In South Africa | |

| |||

| In South Africa | ||

| In South Africa | ||

| In South Africa |

Knowing how to invest in stocks is the will help beginners who are looking for good options to invest their money. After all, this is a great opportunity to achieve big dreams, like getting out of rent or guaranteeing a peaceful retirement.

If you intend to invest and see your money yield more, you have certainly heard about the possibility of investing in stocks online South Africa. Just before getting your hands dirty, you need to know what this type of investment is and how it works.

Want to learn how to invest in stocks? We will answer this and other questions throughout this article, “How to invest in stocks: A beginner’s guide South Africa”.

Our Online Stock Trading experts advise new traders to consider the following before they start online trading. That is why we developed this Trading Online for Beginners South Africa guide.

What are Actions in stock trading?

Actions can be understood as small pieces of an organization. That is, part of its value can be converted into shares and sold to people who were not part of the company before.

Shares are also called shares. That’s because, before digital innovation, they were printed on paper to prove a person’s right to a small company property.

Today, fortunately, everything is done digitally. The record of actions is in the electronic environment. So, no more printed documents are needed to prove that you own a stock in a particular company, for example.

Even with recent technological changes, it is still common to refer to an action as a role.

In addition to stock printing, in the past, the whole process of buying and selling a stock was very complicated. Several mediators and very specific knowledge of finance and techniques were needed to operate the systems.

Many online trading beginners do not know, but the actions are divided into some specific groups. Each group provides the buyer with a type of rights and responsibilities in the company. Know the main types of actions:

- Common shares (ON): when investing in this type of share, you will have the right to vote and will be able to participate in the company’s decisions. It is important to know that the more common shares an investor has, the greater the voting power in an organization’s meeting.

- Preferred shares (PN): if your choice is a PN share, you will not be entitled to participate in business decisions, but will have preference when it comes to distributing company profits, such as dividends, and other compensation.

- Certificate of deposit of shares (Unit): assets composed of more than one type of share, usually common and preferred shares. The logic is very simple: it is as if you bought a set of different actions in the same package.

- Blue chip shares: these are shares of companies with the largest volume of business on the Johannesburg Stock Exchange.

- Mid caps: these are shares that have an intermediate level of trading on the Stock Exchange. As such, these assets are usually owned by midsize organizations.

- Small caps: if you are looking for cheaper stocks, you will usually find this opportunity in small caps. They are actions linked to “smaller” companies, taking into account the financial capital of the organization.

Understanding about each existing type is an important step for you to understand how to invest in stocks. The volume of shares traded daily and the variety of options can confuse investors. Therefore, it is necessary to understand this market well, to be able to observe its movement better.

To make this task easier for you, at OnlineTradings, we have developed an innovative platform where you can see which stocks are currently being traded the most and receive good investment recommendations in real time.

Now that we have explained what stocks are, let’s talk about the environment where transactions involving these assets take place: the Stock Exchange.

What is the Stock Exchange?

In summary, the Stock Exchange is the environment where company shares are traded, in addition to fixed income securities (such as CM Trading), some type of commodity (such as coffee and corn), currencies (such as the dollar and the euro) and other assets.

The Stock Exchange has two very clear objectives: to organize the trading of assets and to ensure the security of the papers and data involved in these operations.

This means that, when buying or selling an asset, the Exchange ensures that the deal is done correctly, between who is buying and the person who is selling the asset in question.

In order to ensure negotiations, the Stock Exchange operates in conjunction with other entities, which are also involved in the organization and security of transactions that take place in this market.

See the institutions that make up this system:

- JSE is the Johannesburg Stock Exchange. JSE Limited is the largest stock exchange in Africa. It is located in Sandton, Johannesburg, South Africa

- The JSE works in partnership with the Financial Sector Conduct Authority (FSCA), which is responsible for ensuring the safety of all transactions on the exchange.

- FSCA is the body responsible for regulating and inspecting this market, preventing fraud and ensuring the integrity of transactions involving shares and other securities.

Do you have any questions about the security of your money when investing in stocks? Always count on our team. We are here to help you understand how this investment works and how to protect your money. That’s why we compiled this guide to trading online for beginners in South Africa.

How does the Stock Exchange work in South Africa?

Before knowing how to invest in stocks, it is important to explain the whole process from the beginning. The Stock Exchange begins operations when a company decides to carry out the Initial Public Offering (IPO), that is, when that organization goes public and makes part of its business available in the form of shares. Usually, companies carry out this procedure to obtain resources that will finance the expansion of their business, be it the opening of new branches or even the launch of new products, for example.

From this moment on, what we call the primary market happens. It is characterized by the transfer of shares that were exclusive to the company to the stock market investors, who are buying these assets for the first time.

The secondary market is the next step to the primary market. It is characterized by the trading of shares between investors.

In other words, the secondary market refers to the purchase and sale of shares made among people who want to invest, without having to go through the company that issued the shares through the IPO.

However, what not everyone knows is that these trades on the Stock Exchange do not take place 24 hours a day. In fact, they follow specific times, and to know how to invest in stocks, you need to pay attention to these times.

Stock trading hours

Now that you know what the Stock Exchange is, it’s time to understand how to invest in stocks. For this, the first step is to know the opening and closing time of the market. Check the table:

| Stock Exchange Moment | Time | Information |

| Pre-opening | 9:45 am to 10:00 am | Kind of auction to determine the opening price of the shares. |

| Negotiation | 10:00 to 17:00 | Time when negotiations and transactions take place. |

| Closing call | 4:55 pm to 5:00 pm | Some stocks have an auction to determine the closing price. |

| After market | 17:30 to 18:00 | It works as a kind of extension, with some restrictions on the actions and amplitude of the variations. |

These hours can undergo changes and adaptations, as in summer time. Thus, it is always good to check the updated schedule on the JSE website and check the operation for a certain time of the year.

You must understand these times to know how to invest in shares and explore the best that the Stock Exchange can offer. Knowing this, it is possible to proceed to the next step and take advantage of the windows of opportunity to invest in stocks.

How to invest in stocks for beginners: step by step to get started

You made it this far and we haven’t talked about investing in stocks yet, have you? Well, you can be sure that all the information we have provided so far will be useful when you are making an investment on the Stock Exchange. After all, your money was won with a lot of sweat and deserves to be truly valued.

How about knowing how to put everything you’ve learned into practice? Here are the 4 steps you need to take to start investing in stocks right now:

Trading Online for Beginners in 4 Steps

1. Carry out financial planning

Before you start investing all your money to buy stocks, as a beginner, you need to plan what you’re really going to do. Starting to cook without knowing which dish to serve in the end is not a good idea, right? With your finances, the logic is the same.

Knowing where you want to go and what achievements you want to accomplish is crucial for you to have good results.

Have you ever stopped to think about where you will get the resources to invest your money? Did you align your expectation of earnings to the reality of your pocket? These are some questions that must be answered during your planning.

This is an essential process for the success of your investments. Having organization will be the basis for you to achieve your biggest dreams and prevent you from taking unnecessary risks. So it is worthwhile to dedicate time and effort in this step.

In addition, it is much easier to be successful when investing in stocks when you are in good financial control and following a larger plan.

2. Open a trading account

For you to be able to invest in shares on the Stock Exchange, it is necessary to have a stockbroker. Find a good online stock broker and open a stock brokerage account. These entities act as a bridge between investors and investments.

Many people believe that it doesn’t matter the broker that the important thing is to know how to invest. This is a big mistake, as these institutions should be seen as a partner that can make the path between you and your dreams a lot easier.

Here at OnlineTradings, we are committed to bringing you the best investment experience on the Stock Exchange through this Trading Online for Beginners Guide SA.

With that in mind, we created a simple and easy-to-use platform that you can invest in stocks with a few clicks, just like you buy a shoe or order food online.

Therefore, when choosing a stockbroker, it is essential that you know the institution well and the cost-benefit that it offers. Choosing well can make a big difference in your results, in addition to avoiding unpleasant surprises.

Nowadays it is possible to open an account with a broker in a few minutes, through a simple process. At OnlineTradings, this process is even easier, everything is done over the internet and you can do it by phone or computer, in a short time. The cool thing is that you don’t pay anything to open or maintain your OnlineTradings account.

3. Understand your investor profile

When activating your account at a brokerage, you will have access to several investment options, however, not all are suitable for your profile. That is why it is important to understand your preferences and expectations regarding investments, to find out which investor profile you fit into.

At OnlineTradings, you can identify your investor profile for free. Through a very simple and online questionnaire, you can answer in a few minutes some questions about your preferences and risk tolerance.

This profile is important when defining how to invest in shares, as not everyone has the same characteristics as an investor. Understanding this logic, before you start investing your money, is essential to prevent you from entering a situation in which you are not comfortable.

4. Choose the right stocks to invest

Choosing the best actions of the moment is the last step of this journey. It is worth saying that knowledge is essential to success in choosing. That way, the more you know how to identify the right time to buy or sell a stock, the better your results can be.

The good news is that, nowadays, access to investments is more democratic.

Through the internet it is possible to buy or sell shares of companies, investing large amounts as well as smaller amounts of money.

Want an example as a beginner trader? At OnlineTradings, you can invest in shares on the Stock Exchange with amounts starting at R $ 200.00. So, you don’t have to give up learning how to invest in stocks just because you don’t have multiple figures in the bank.

You can choose actions according to the resources you have to apply, but without forgetting to align with your profile and planning. However, if you still don’t know how to get started, know that you are not just making that choice.

OnlineTradings has market experts who are always on the lookout to identify and offer recommendations for the best investments at the moment. Thus, you can invest in stocks with great chances of success, relying on the expertise of our analysts.

How to invest in stocks in a simple way

You must be thinking that, to follow the steps presented and start investing in the stock market, you need a long and bureaucratic process, right? Well, until recently, that was the reality.

Thankfully, dealing with a complicated and unintuitive home broker is no longer necessary. The OnlineTradings platform was designed to facilitate your investments and help you achieve your biggest dreams. You can open your account, transfer money and start investing in shares in a very short time.

Simplicity also appears in the way you receive investment recommendations. Throughout the trading session, our specialists carry out analyzes based on market data and are able to identify which are the opportunities that are most likely to win.

Here at OnlineTradings, we are always concerned with making recommendations as transparent as possible for you, which is why we developed this Trading Online for Beginners SA guide.

Therefore, when choosing an opportunity recommended by our team, you have access to the main information about it even before investing, such as risk of loss and also potential for gain.

And you want to know the best part? By investing through a recommendation made by our team of experts, you only pay a brokerage fee if you make a profit. If the opportunity is not successful, the brokerage is zero.

What are the advantages of investing in stocks?

You already know that the investment market has several options to choose from. From traditional Savings, through fixed income securities, to company stocks and also to Futures Market contracts, all these alternatives are ways for you to invest your money.

However, not all options have the same profitability. The savings, for example, is more of a way to save money than to invest it. Fixed income securities, on the other hand, may yield more than the booklet, but they are still options for those who want to invest, giving more priority to safety than to profitability.

The great advantage of investing in stocks is the possibility of achieving better results and thus achieving bigger dreams. In addition, time is also an advantage. It is possible to invest as a trader, in agile operations that can only last a few minutes, as in Day Trade, or invest in the long term, for those who do not have time to follow the market all day.

If you are willing to take more risks in search of greater returns, investing in stocks can be a great opportunity.

Want to see a clear example of how stocks can become the best investments? In 2002, Netflix launched its shares for the first time on the United States Stock Exchange. According to data collected by CNN, those who invested US $ 1,000 in the company, in May 2017 would have about US $ 140,000.

Have you thought about investing in the next Netflix and achieving an appreciation 140 times higher than you initially applied? Of course, this is just one example, which, despite having occurred on the United States Stock Exchange, serves to illustrate the possibilities that the Stock Exchange can offer.

However, it is always good to remember that the profitability of the past does not serve as a guarantee of what is yet to happen. To identify the opportunities now, it is always good to pay attention to the stock exchange coming and going and counting on the experience of those who know the market a lot.

What are the risks of investing in stocks?

When people hear the word risk, many new beginners automatically give up investing in stocks because they think they are going to lose a lot of money. In fact, investment in the Stock Exchange is more risky than fixed income options. After all, stock prices go up and down all the time.

However, it is possible to know how to deal with this risk and to use strategies, tools and platforms that help to minimize the danger. Some interesting ways to mitigate the risks are the stock analysis and the definition of the estimated loss.

Analyzes help to identify an opportunity most likely to happen and take advantage of it in time to have good investment results.

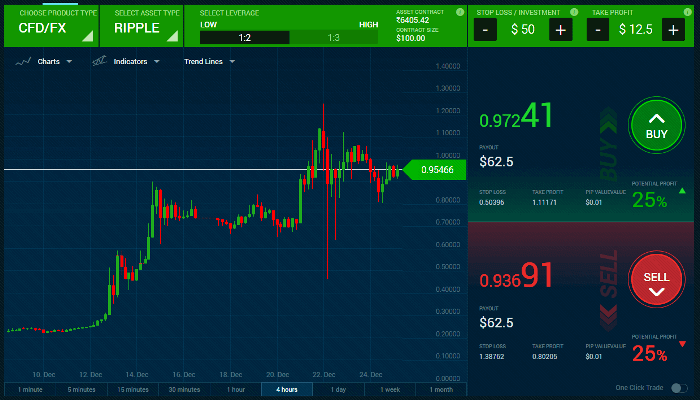

The estimated loss is a tool that allows you to program a maximum loss limit that you are willing to accept. Also known as stop loss, this mechanism is extremely important because it prevents the losses from being even greater.

See: imagine that you bought a stock for R $ 50.00 hoping it will appreciate. However, you know that this market can change the scenario all of a sudden. So, you defined the value of R $ 48.00 as an estimated loss, preparing in case the price drops instead of appreciating.

It may seem strange to accept losing money. But know that this attitude is highly valued by those who invest with strategy.

That is why we emphasize that knowledge is also important to know how to invest in stocks and mitigate risks. In addition, using data to base your investments increases your chances of success.

At OnlineTradings, we also have this concern. So much so that our specialists are always eyeing the market, analyzing all the details, to pass the recommended opportunities of the moment for you to take advantage of.

As we said just now, when investing in a stock recommended by our experts, you will only pay the brokerage fee if you make a profit. Thus, we make clear our proposal to always deliver the best opportunities for you and see you achieving your goals.

In addition, our online trading beginner platform was designed so that you have access to all the relevant information of a transaction, such as minimum value and earning potential. This includes, of course, the risks that buying and selling an asset can present.

At OnlineTradings, you know, before you even invest, how much you can lose and then decide whether to accept the operation or not.

Well, now you know how to invest in stocks and can start right now. Remember: planning should be the first step in understanding your reality and establishing your goals according to the resources you have now.

In addition, it is important that you continue to search for information regarding trading online for beginners in South Africa that will be useful on your journey. Acquiring knowledge will be essential for you to take every step towards success, preventing uncertainties from harming your performance and achieving excellent results when investing in stocks.

Count on our team to test by your side all the way towards your investment success.

Trading Online for Beginners Tips in South Africa

- Speed of execution – Thanks to the high variety of trades you may create in an exceedingly day, speed of execution is vital – As is obtaining the value you would like, after you would like it.

- Costs – The lower the fees and commission rates, the additional viable day commercialism is. Active traders are going to be commercialism usually – minimizing these commercialism prices it important.

- Regulatory compliance – ensure your broker is regulated. They’ll be lawfully duty-bound to shield your monetary interests.

- Support – No matter your day commercialism strategy, you’ll in all probability would like help at some purpose, thus rummage around for on-line brokers with fast response times and powerful client support.

- Spreads, Leverage & Margin – As daily dealer need competitive spreads – you may additionally want sure leverage levels and low margins.